Rebalancing Relayers & Treasury Management

Many teams hold portions of their token treasuries across several chains. Increasingly, teams may use these token balances to fund relayer accounts that advance transactions for users within their application or participate as solvers within other liquidity networks (like Decent's!). Decent is the ideal choice to rebalance accounts across chains because we offer secure routing to any network without liquidity constraints.

Decent meshes our fast bridge routes with chains' canonical bridges. This means that teams can leverage the security of canonical bridges to move funds between networks. Canonical bridging protects your treasury against re-org risk and does not introduce any incremental trust assumptions beyond those of the underlying chain. Importantly, canonical bridging burns and mints native assets, so there are no liquidity constraints.

Rebalancing Relayers

Relayers encounter three significant challenges today to scale with new chains and the applications deploying them.

- Challenge periods stressing available liquidity

- Price exposure via non-ETH gas tokens

- Guaranteed execution

Capital Efficiency with Challenge Periods

Canonical bridges for optimistic rollups require a seven day challenge period to confirm withdrawals. This poses a difficult user experience as users have to wait a week to claim their funds on the settlement (hub) chain. For relayers, challenge periods stress liquidity requirements.

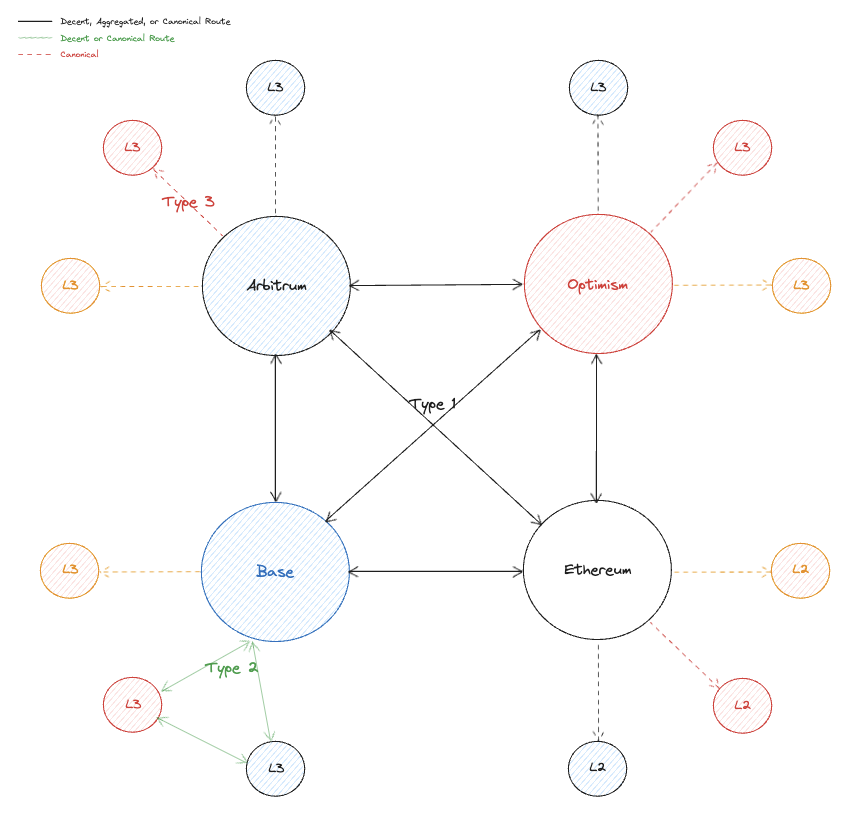

Decent views chains as hubs or spokes. Hub chains have extremely deep liquidity on bi-directional fast bridge routes and are typically settlement chains for spokes. Spokes may only have their canonical bridge and fast bridging going towards the spoke. We recommend that relayers hold the significant majority of their funds on hub chains and shuttle funds to spokes as needed. Done well, relayers should never have trapped liquidity.

Because Decent can securely route any amount of money to any chain in minutes, relayers never need to hold more than 10-20 minutes worth of liquidity on a single chain. As soon as your relayer account passes a threshold where it is certain to be depleted, teams can initiate a transaction in their back end to transfer money from a liquidity hub to this account.

Last Mile Liquidity to Mitigate FX Exposure

Many transactions need to be settled in tokens that a relayer cannot hold because they are either unsafe or volatile. Relayers commonly hold primary assets like ETH, USDC, or USDT; however, increasingly, relayers must (or would like to) settle transactions requiring longer-tail tokens. Common transactions of this type include:

- Any transaction on a chain with a non-ETH gas token (Degen, Xai, Polygon, Mantle, etc.)

- NFTs denominated in ERC20's

- DeFi deposits

For large applications, the ability to denominate transactions in their token can be a significant driver to launch their own chain. The combination of both a new chain and a custom gas token very quickly fragments liquidity or introduces risks beyond that a relay team is willing to accept.

Decent integrates DEX's directly into our routing so that we can settle transactions in any token on any chain. Relayers can continue holding their funds in primary assets but tap into Decent to call our swapAndExecute functions to settle transactions in longer-tail ERC20 tokens without introducing incremental latency. See the diagram here. We recommend that relayers use Decent to build the calldata to execute orders they receive to tap into this functionality. Relayers can also use the bridgeAndExecute function to quickly also settle transactions on chains where they might not have funds. We refer to this value prop as last mile liquidity.

Guaranteed Execution

Relayers often struggle to guarantee execution for the orders they receive. Decent's routing is atomic in that any transaction submitted on the source chain is guaranteed to execute on the destination chain. Because we can execute any arbitrary transaction on any chain, relayers can use Decent as a fallback route in their own execution and provide a best-in-class user experience.

Get started

- Create an account or log into the Developer Console

- Check out how to send cross-chain transactions server side with Decent's APIs

- Have questions?

- Chat with a live support member through our on-site messenger at https://help.decent.xyz

- Email [email protected]